Donations in the digital age

The importance of hyper-transparency

The UK charity sector is at a fundraising crossroads.

The number of people donating has been dropping since 2015/16: from 69% to 65% of the UK’s population, according to the Charities Aid Foundation’s (CAF) annual Giving report for 2019.

That was the year that scandals about hard-sell tactics being used on vulnerable donors prompted fundraising regulators to get tough on the sector. Just 48% of the 12,000 people surveyed by the CAF now believe charities to be trustworthy; a significant and concerning drop from 51% in 2017.

That lack of trust is compounded by another simple fact: in our increasingly online world, the nature of making payments has changed – and charities are falling behind.

Blockchain: a quick guide

So is it all over for public fundraising? Far from it.

Charities are needed now more than ever. And new technologies are offering them a means to restore trust, and recruit and retain donors, by make donating easy, user-friendly and, above all, hyper-transparent.

Believe it or not, one answer lies in blockchain. No, not gambling your reserves on bitcoin; rather, the technology that underlies the cryptocurrency.

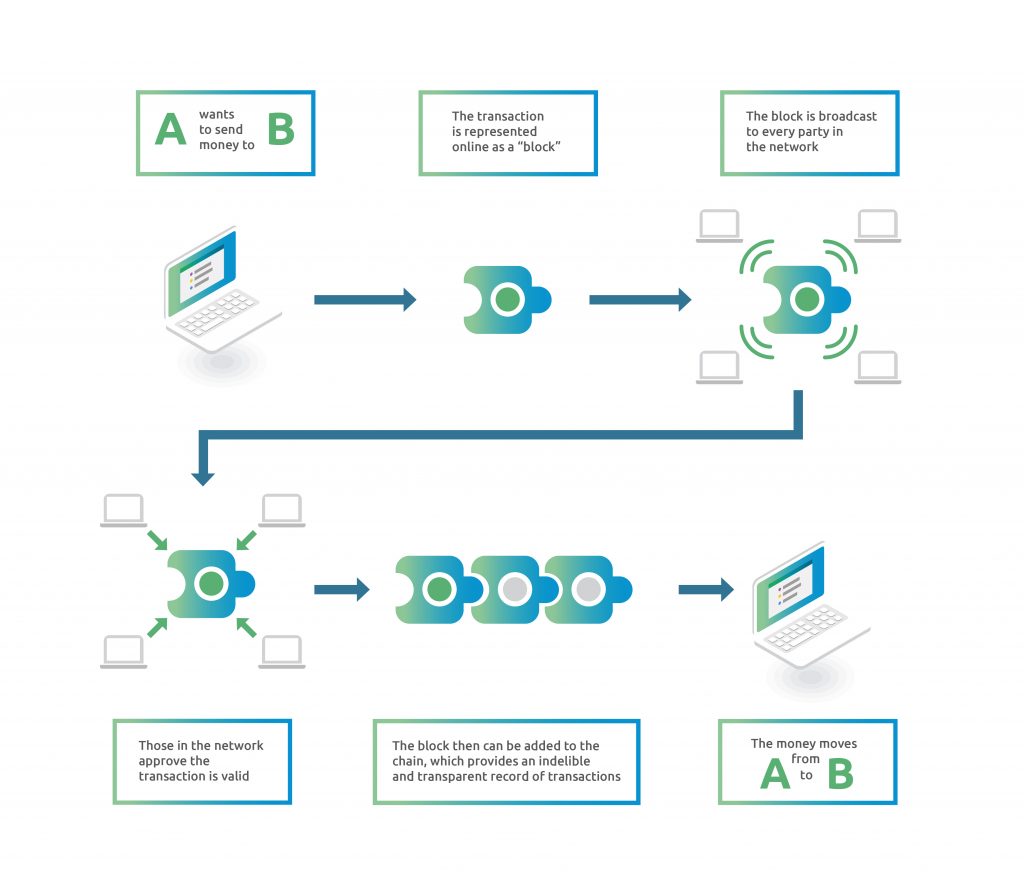

Before you reach in resignation for your old collecting tin, blockchain is not actually that hard to understand.

Essentially, the ‘block’ is digital information, and the ‘chain’ is a public database that is contained on millions of computers – even yours, if you wish.

Each ‘block’ contains information about transactions such as time, date, partially anonymous details of who’s involved, and a unique code called a ‘hash’ to distinguish it from any other transaction.

It’s broadcast to all the computers in the network, which validate it and add it to the chain. The transaction is then completed, and the money moves.

Security and transparency

How can this help rebuild trust in charities?

Firstly, by increasing security.

There’s no centralised version of the blockchain for a hacker to corrupt;to edit details of the transaction would require hacking into so many computers as to render it impossible.

Secondly, by improving transparency. Anybody can view transactions on a blockchain, although names will be limited to a username. Customers or donors can view the record of their transaction and trace its path to the beneficiary. As any fundraiser knows only too well, donors want to know how their money is spent – and now they can, with minimal admin cost to the charity.

Unlocking donations

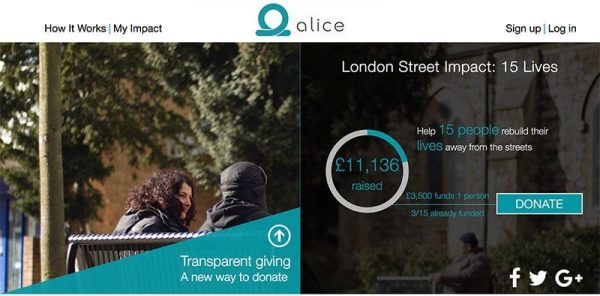

One platform putting this into practice is Alice, which is powered by Ethereum blockchain. Ethereum has developed blockchain for use by a wide variety of applications. Those ‘blocks’ can contain information not just about financial transactions, but about pretty much anything.

Most importantly for givers, perhaps, is the fact that Alice allows them to place conditions on their donations.

Take St Mungo’s. It worked with Alice on an appeal for £50,000 to help rough sleepers in London. Donations were unlocked only when the charity could evidence certain social goals set out at the start of their appeal.

Donors could track when those goals were met and their money was released. They could follow the progress of the rough sleepers, for example seeing when they found a new home, and what steps they were taking to solve their addiction issues. And donors were even entitled to demand their money back if they felt it did not achieve the promised result.

Embracing digitisation

Another area in which charities with foresight are embracing digitisation is contactless payment technology. As fewer people carry cash, collection boxes are slower to fill with loose change. But several charities now offer cashless options in store and even for street-based fundraising.

Homeless people are also at risk in a cashless society, as passersby have less to hand out. TAP London is a new non-profit that has set up 35 donation points to allow for cashless donations to the 22 charities in the London Homeless Charities Group. It has the backing of the Mayor of London, and collected 2,581 donations totalling £7,743 in its first two weeks.

Meanwhile, the crowdfunding platform Beam allows donors to make payments to provide support and training to rough sleepers, helping them transition into work. As well as making it easy to pay, the platform lets them see that their money is being spent well and having the desired effect.

The future of fundraising

Of course, digitisation has pitfalls for charities too. It can diminish their control over their finances and programmes and undermine their role as the link between donors and beneficiaries.

But charities can’t afford to be left behind by new technologies. And if they’re to restore public trust, they need to embrace change.

So what’s next? Some charities are already riding the blockchain wave: the Red Cross and Save the Children take donations in bitcoin. Others are going digital to increase accessibility: the British Heart Foundation is the first charity in the UK to accept voice donations via Amazon’s Alexa.

What seems certain is that donors’ demands for user-friendly, hyper-transparent payments are not going away – and this can be for everyone’s benefit.